Our story is built on compassion and supporting those who need it most. Explore our journey of how we’ve always put people first.

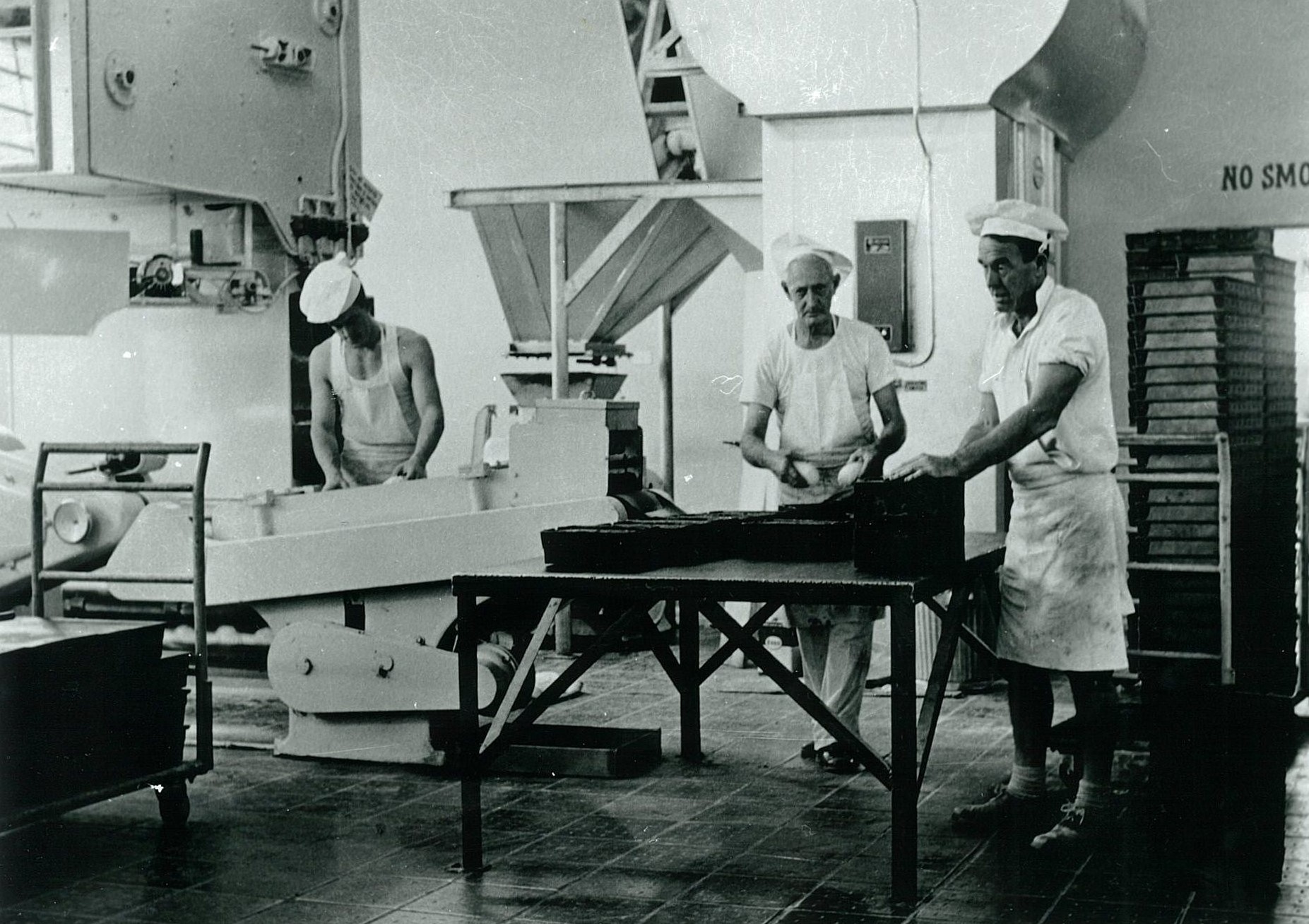

Our story begins. Recognising the need to give financial help to injured workers in the NSW baking, plumbing and transport industries, Great Southern Bakeries and the Master Bakers Association establish the Master Bakers’ Mutual Indemnity Association Ltd, run by a small team of five.

The concept of workers insurance spreads to other industries and the Master Plumbers’ Mutual Indemnity Association Ltd is formed.

More industries join in – the Master Carriers’ Mutual Indemnity Association Ltd is formed.

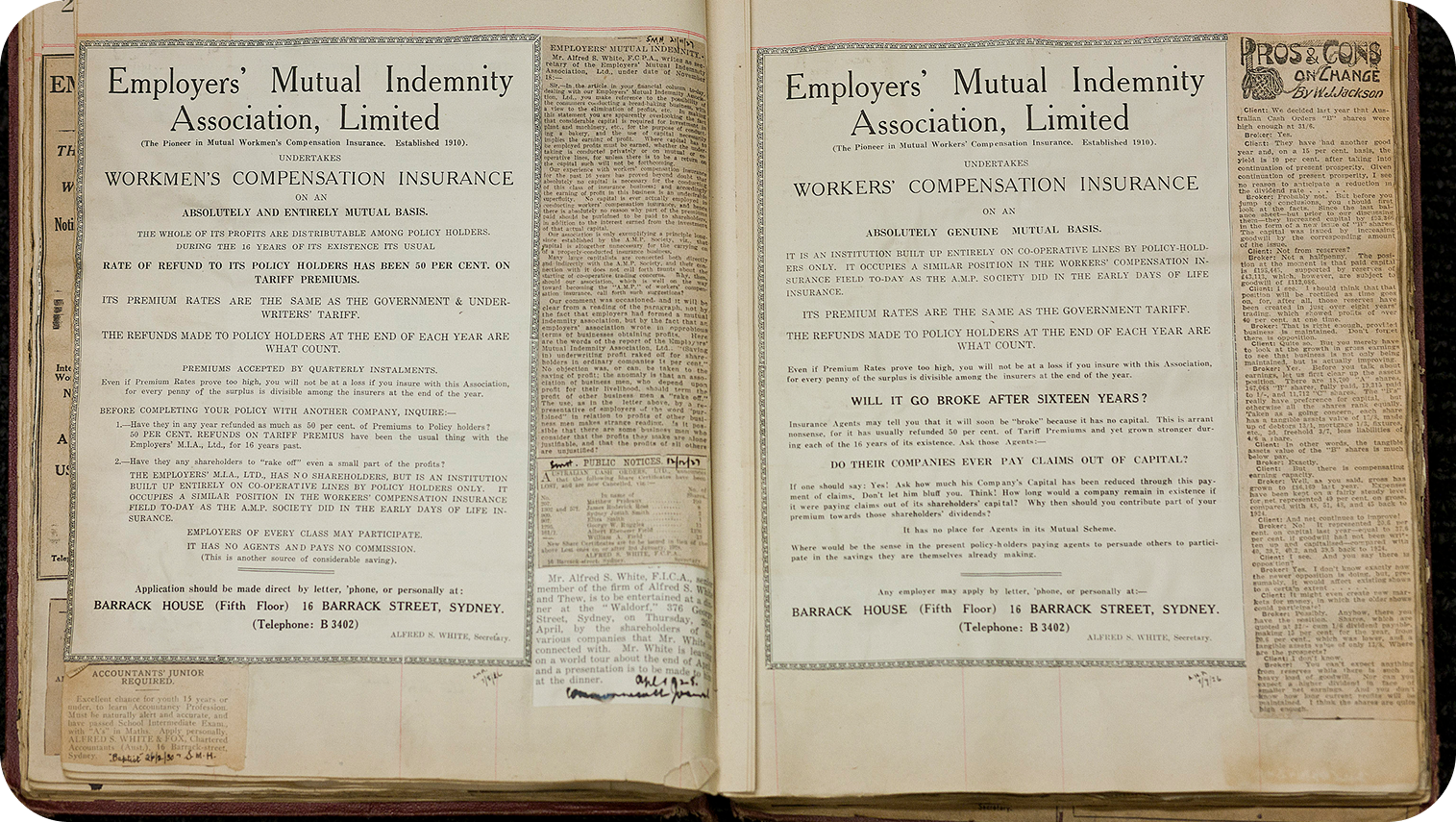

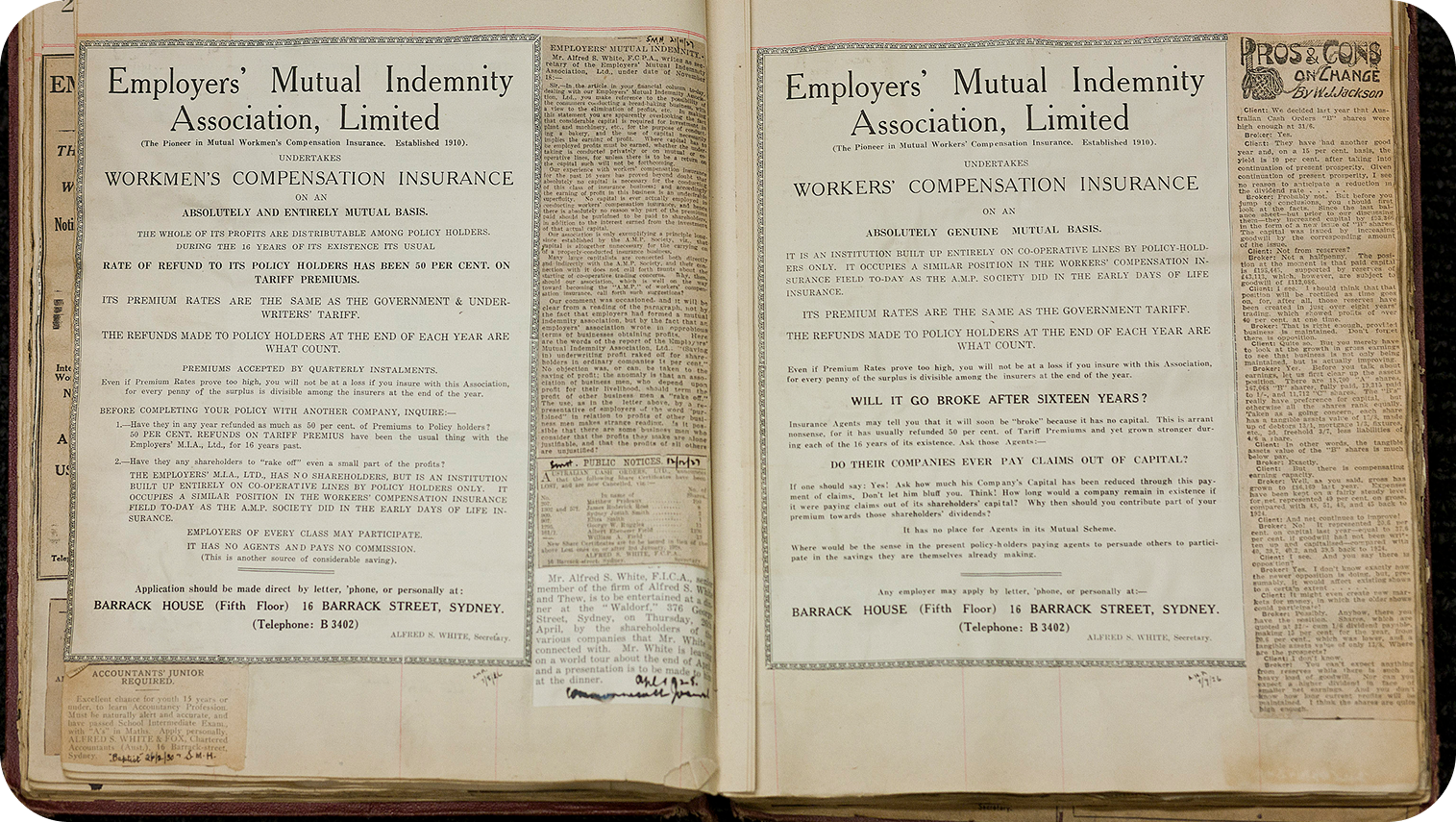

The associations merge and we become Employers’ Mutual Indemnity Association Ltd – the foundation of the name we are known by today.

Our new structure is so successful that policyholders receive a 60% rebate off their premiums.

Despite the Great Depression forcing businesses and insurers to close, we continue to thrive and still pay substantial bonus refunds to policyholders.

We achieve a 54-year streak of paying generous rebates averaging 50%, far more than most insurers at that time – a sign of our success and expertise in workers compensation.

We become a Managed Fund Insurer for WorkCover NSW (now icare) – marking a new era of leadership in workers compensation in NSW.

We continue to handle claims for WorkCover NSW, managing a $29M premium with a team of 35 employees.

We expand into mining, taking on the Coal Mines Insurance Industry Scheme, and into public liability for association schemes – strengthening our reach and expertise.

We start to manage workers compensation for public sector workers as an appointed Claims Service Provider for WorkCover NSW’s (now icare) Treasury Managed Fund (TMF).

Our workforce reaches 240 employees to meet demand.

We’re appointed sole agent for WorkCover South Australia (now ReturnToWorkSA).

We retain our entire portfolio in the first NSW Scheme Agent contract tender – the only provider to do so.

We grow to 540 employees.

We form a joint venture with the Australian Hotels Association NSW to launch Hotel Employers Mutual Ltd, giving hotels and pubs a new choice for workers compensation.

We achieve ISO 27001 certification, the global standard for information security, to protect and manage our data.

We celebrate 100 years, reaching a 1,000-employee milestone and managing over $1 billion in premiums.

In NSW’s second Scheme Agent contract tender, we again retain our entire portfolio and are awarded significant long-term claims.

WorkCover NSW (now icare) doubles our share of the scheme to 50% as we take on claims for NSW Police and Fire and Rescue NSW frontline workers.

We continue to manage claims for NSW Health (South).

ReturnToWorkSA extends our contract, awarding us 50% of their scheme.

Clubs NSW joins Hotel Employers Mutual Ltd, and the scheme is rebranded as Hospitality Employers Mutual Ltd, revolutionising workers compensation for the NSW hospitality industry.

In 2012, a framework was introduced to support the delivery of activities, investment and research for members via Member Benefits.

We create a new custom claims management system – Pivotal – to simplify personal injury claims, making the process faster and more effective.

We win a national contract to manage claims for Woolworths under its self insurance scheme, supporting over 220,000 Woolworths employees.

We launch an industry-first mobile case management program in South Australia, offering ground-breaking in-person help to workers and employers to speed up recovery and return to work.

We retain our entire portfolio for the third time in NSW’s Scheme Agent contract tender.

We become WorkSafe Victoria’s newest workers compensation agent, supporting workers and employers across the state.

We set up mobile case managers in Victoria to provide face-to-face support.

We launch EMLife – a specialist claims management service for life insurance.

We expand our claims services into general insurance through the management of accident and health claims, strengthening our people-risk insurance offering.

We’re awarded 100% responsibility for icare’s new claims from January 2018 in the NSW Scheme Agent contract tender.

We take on workers compensation claims for federal employers, appointed as a third-party administrator for Comcare.

We’re now supporting over 320,000 NSW businesses under icare.

The ACT Government chooses us to self insure its most valuable asset – its 22,000-strong workforce.

icare entrusts us with Treasury Managed Fund (TMF) claims for another five years, as we continue to help injured public sector workers.

icare extends our agreement in NSW for another year with a $20M joint investment program to support workers and employers.

As COVID-19 hits, we introduce automation to speed up claims processing.

We commence claims management for CTP insurance in NSW.

We win Best Service Provider at the Insurance and Business Australia Awards for EMLife.

Following changes to the Employers Mutual Limited Constitution, the program for Member Benefits was amended to “Mutual Benefits Program” in 2020.

ReturntoWorkSA selects us to handle claims for another five years.

WorkSafe Victoria extends our contract for another two years, growing our market share to 21% as we support 50,000 Victorian businesses.

Our mobile case managers hit the ground in NSW, delivering in-person support to injured workers and their employers across the state.

We reach a $100M investment milestone in the Mutual Benefits Program, creating safer workplaces and supporting workers across Australia.

We secure a 10-year contract with icare.

WorkSafe Victoria extends our contract to 2025.

We launch Surgery Sleuth, our industry-first online tool that ensures accurate surgical billing for reduced premiums.

We commence claims management for CTP insurance in in South Australia.

We lead icare performance rankings in NSW while managing 76% of open claims.

We introduce AI into claims management for the first time, to help our claims teams interpret complex medical information for informed decisions.

We launch our new app, RecoveryMate, to give injured workers easy and quick access to their claim information.

In partnership with ReturnToWorkSA, we design a new innovative claims system to improve the scheme and its outcomes.

Our Victorian mobile case managers hit major milestones in the state, clocking up 10,000 visits and two million kilometres travelled.

We expand into workers compensation for the Roman Catholic Church, trading as Trinity Insurance.

We rebrand Hospitality Employers Mutual Ltd as Hospitality Industry Insurance as we support cafés, restaurants, and takeaways.

Our Pivotal system celebrates 10 years of success, managing 11 workers compensation schemes across Australia.

Our workforce reaches 3,500+ employees.

We’re officially certified as a Great Place To Work® and named a top-10 Best Workplace in Australia 2024 (large employers) – recognising our people and workplace culture.

We achieve a record $142M invested in the Mutual Benefits Program.

WorkSafe Victoria extends our contract to 2028.

We take on workers compensation claims for federal employers, appointed as a Third-Party Administrator for Comcare.

We celebrate 18 years of support in South Australia and 50,000 mobile case manager visits across the state.

Our self-insurance portfolio grows to 15 clients nationwide, supported by 150+ claim specialists.

After 20 years of helping injured public sector workers, we’re awarded Treasury Managed Fund claims for another 10 years – reflecting our deep understanding of government needs.

Our care for NSW frontline workers grows as we become claims managers for Ambulance NSW, joining our support for NSW Police and Fire and Rescue NSW.

We’re named one of the Top 50 Best Workplaces for Women by Great Place To Work® Australia, recognising our diverse and supportive work environment.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

The EML Group is made up of a group of companies owned and operated by a partnership between Employers Mutual Limited & The Trustee For ASWIG Management Trust ABN 23 923 166 503, to find out more information about the EML Group click here.