An Earning Capacity Assessment is performed to determine the appropriate weekly pay rate for a worker whose circumstances are described in Section 40A of the 1987 Act.

It helps ensure a worker’s weekly pay rate is aligned with their current earning capacity.

|

Find more information on police career transition on our website, including managing other aspects of your finances. |

A Section 40A rate can be applied in the following circumstances:

- the worker is employed but not earning up to their pre-injury earnings

- the worker is unemployed and is seeking suitable employment

- the worker has unreasonably rejected suitable employment

- the worker has received at least 52 weeks of partial incapacity payments

The assessment will include a review of your functional restrictions and vocational options, and takes into consideration the labour market conditions. EML may engage an external provider to undertake an independent assessment.

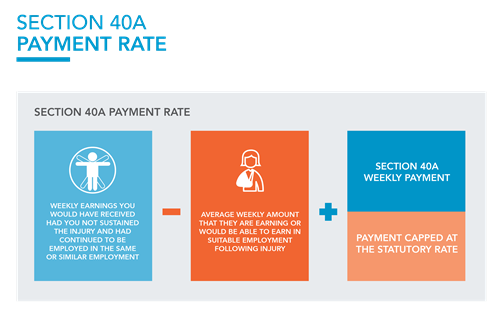

Calculating weekly pay entitlements under section 40A

The difference between the worker’s pre-injury gross wages and the assessed post-injury gross earning capacity is calculated, and the worker will then receive the difference between these amounts up to the statutory rate.

If a worker’s weekly entitlements are to be reduced or discontinued, EML must provide adequate notice. For workers who have been receiving weekly payments of compensation for a continuous period of one year or more, the prescribed period of notice is six weeks.